Trump, who was simply the company’s president and later Chief executive officer, went on and then make millions of dollars annually inside the income and bonuses despite the hefty losings. Because of the 1996, the brand new inventory achieved a leading out of $thirty-five a portion just before plummeting later on you to definitely year, partly because the company bought various other casino to have $a hundred million over their estimated $eight hundred million well worth, The brand new York Moments said in the 2016. Donald Trump’s social networking organization might go societal when 2nd week, paving the way to have a possibly huge windfall to possess an old president whom raked within the 10s of huge amount of money the past day one of his true enterprises is listed on a currency markets.

In any case, you’ve discover oneself regarding the jealous reputation of obtaining a relatively large sum of money burning an opening on the wallet. Windfall Gambling establishment are rated 1165 of 1651 casinos assessed with a good rating out of 2.8 out of 5 once 7 ballots and has 37 Harbors considering away from Warm Game which have an average rating of step three.5 out of 5 once 140 ballots. The best current for the buyer, it credit is good for another looking expertise in certain of the biggest brands in the outdoor tools, household items and you may hand-crafted precious jewelry.

Study Maybe not Associated with Your

Away from Lobster Mac computer & Parmesan cheese so you can remarkable hamburgers and you may charcuterie, you can lose your favorite foodies to the world-group morale dining out of 1898 Societal House. Nor will we have an excellent paywall — you want to continue all of our work accessible to as many people that you could. So we believe in the fresh generosity of individuals and you will fundamentals to help you fund our very own works. Our reports is generally republished on line or perhaps in printing lower than Imaginative Commons permit CC By the-NC-ND cuatro.0. I query that you revise just for layout or to reduce, offer right attribution and you can link to all of our website.

Windfall Gambling enterprise Incentive

Internal revenue service.COM try a non-authorities site built to help taxpayers find exact, easy-to-know tax advice, valuable taxation items, and you can tax-relevant characteristics. For those who click over here inherit an enthusiastic IRA from someone besides their inactive spouse, the newest Internal revenue service doesn’t allow you to address it since your individual IRA. Hence, you aren’t allowed to build contributions for the handed down IRA otherwise “roll over” one quantity.

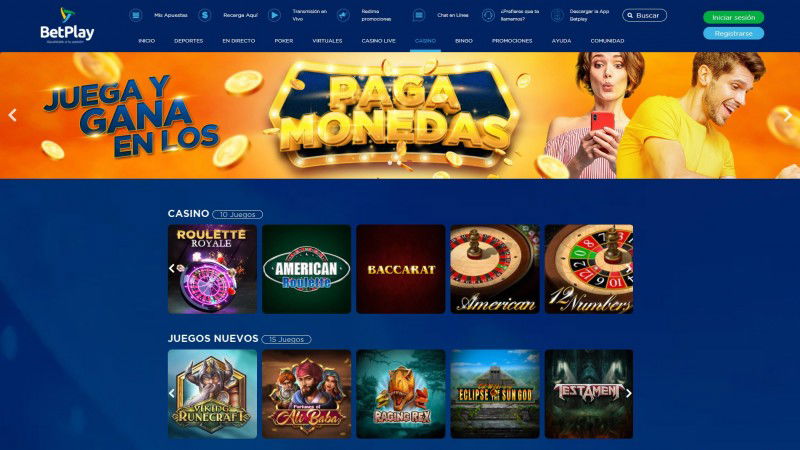

For more information, come across Irs Guide 525 (Nonexempt and you will Nontaxable Income). When you yourself have obtained a lawsuit and also have already been granted a great economic judge settlement, you could are obligated to pay Federal taxes in it. While you are particular agreements (including damages for personal actual injuries otherwise actual disease) are considered low-nonexempt because of the Internal revenue service, almost every other sort of problems try taxed since the ordinary income. Windfall Gambling enterprise you’ll manage with which have a sleeker looks, nevertheless the site can not be faulted for its ability to accommodate all major mobile operating system. To other developments, Windfall’s local casino collection might possibly be stronger when the the fresh harbors and dining table games was additional.

It’s similar having Hyper Ports that have Baron Samedi games and you can features a positive change of Frooti Booti harbors. It’s linked to Hyper Ports with Super Fruits Joker games and various with Ra plus the Scarab Forehead cellular ports. Set-aside the desk for a perfect vacation dinner experience during the Northern Quest.

Gift ideas and you may inheritances are tax free, no matter what number (IRC point 102). Particular inheritances, yet not, ultimately trigger money in respect out of an excellent decedent IRC area 691(a). For example, a boy which inherits a $one million IRA away from their mommy is not taxed to your inheritance of the IRA, but need to statement income when distributions are drawn. An income tax deduction is actually invited on the part of federal estate income tax allocable to earnings in the event the earnings is includable IRC area 691(c).